Luxury level Credit & Tax Solutions the Holliday way

holLiday credit solutions

OUR

OUR

SERVICES

SERVICES

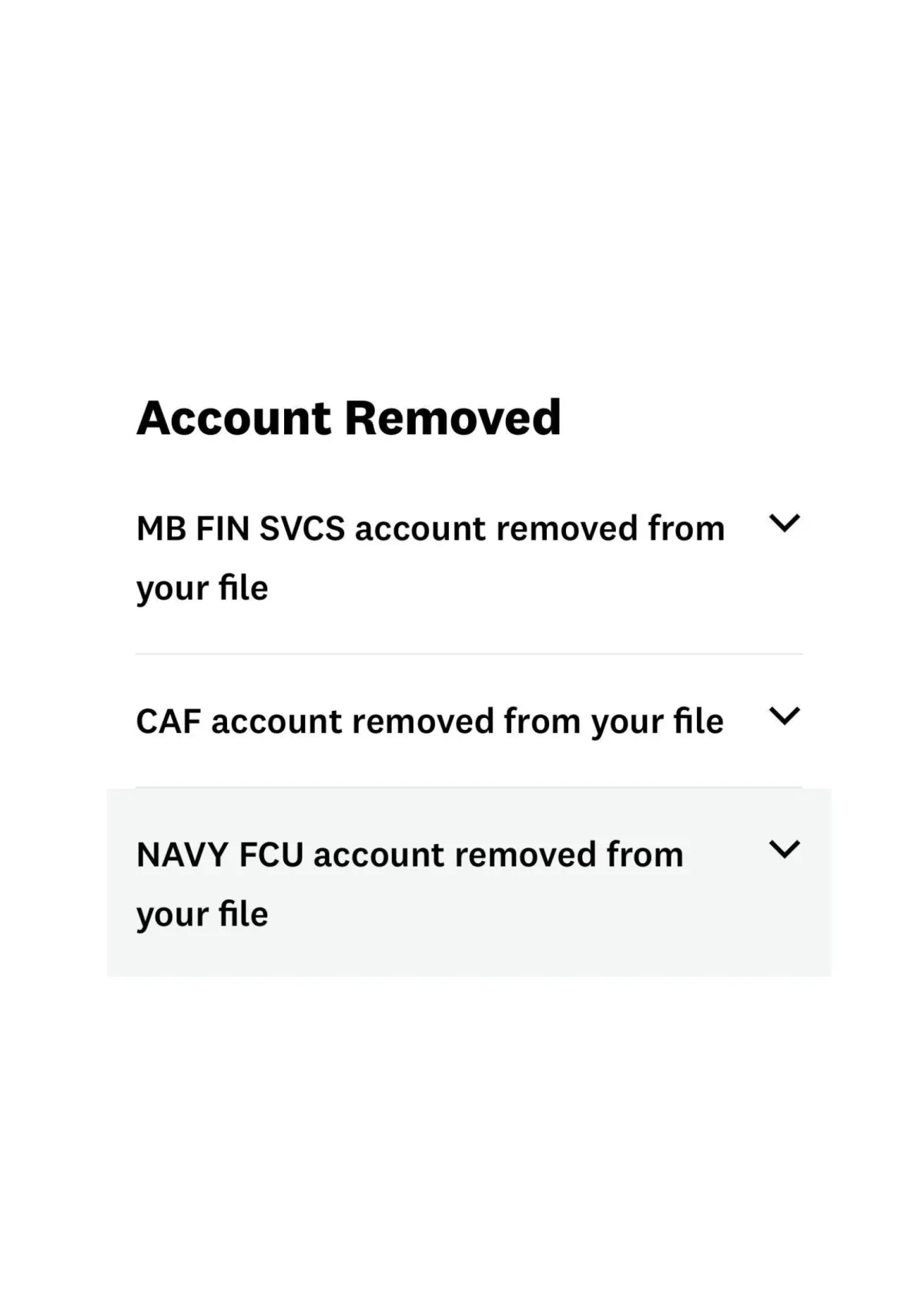

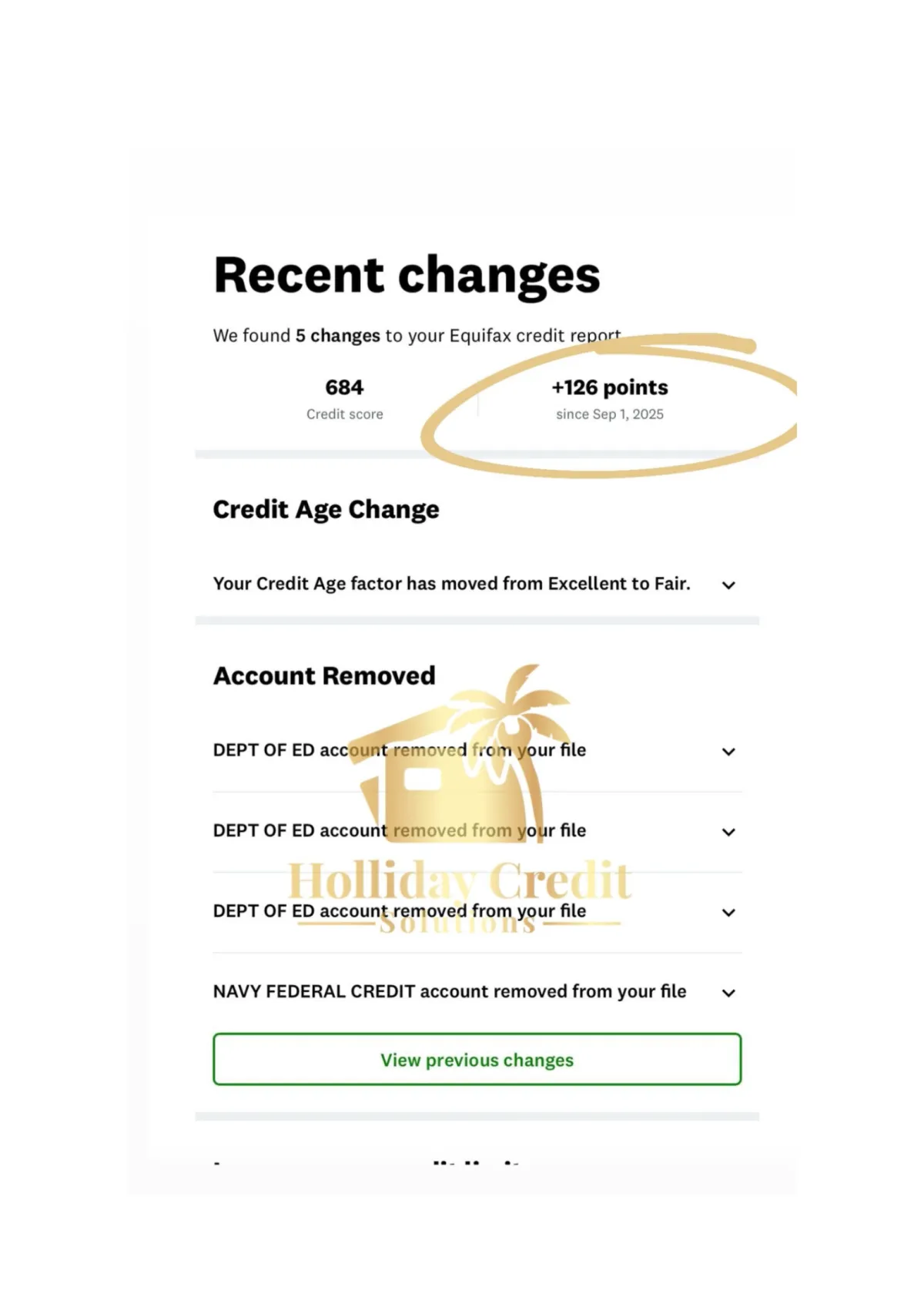

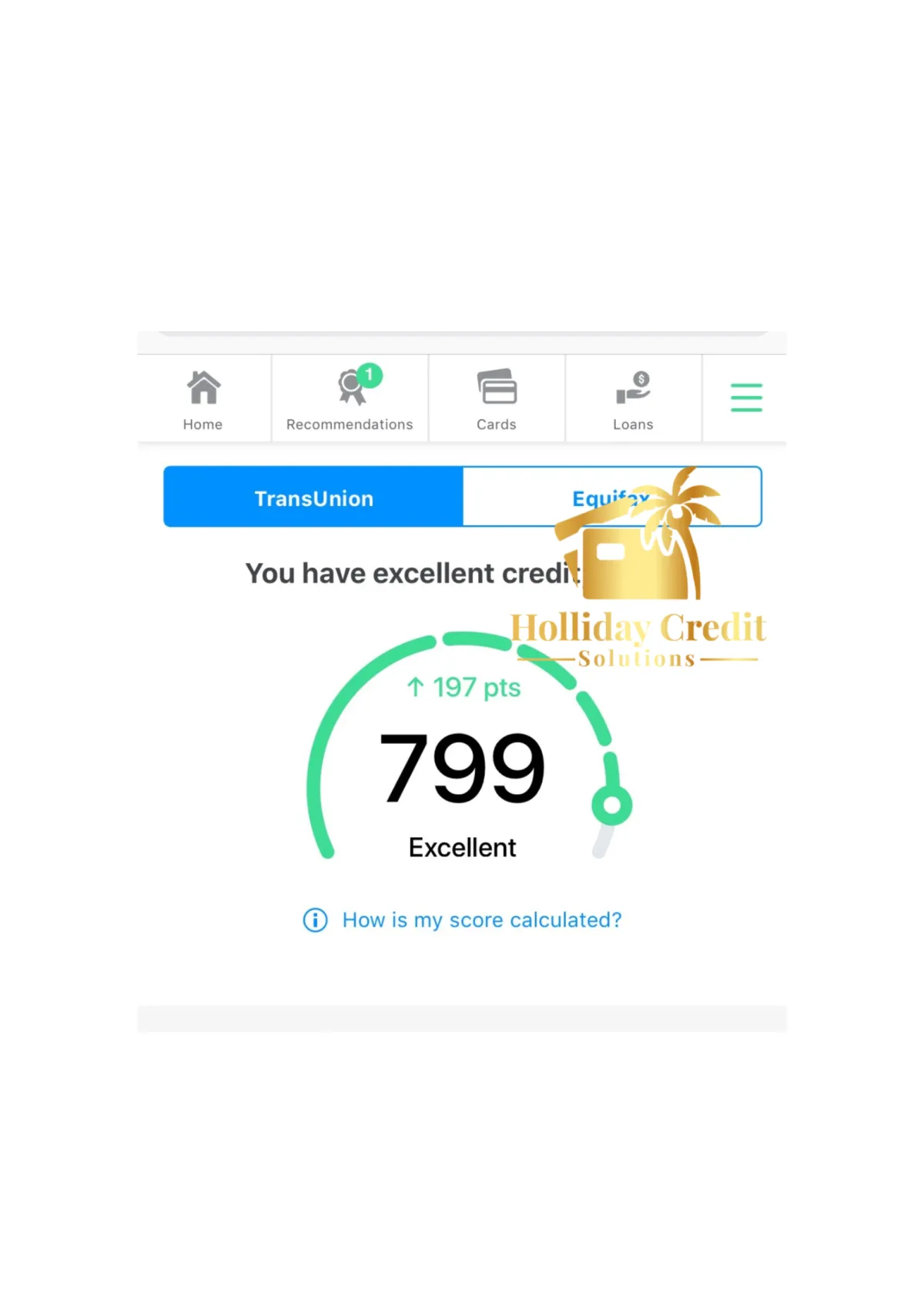

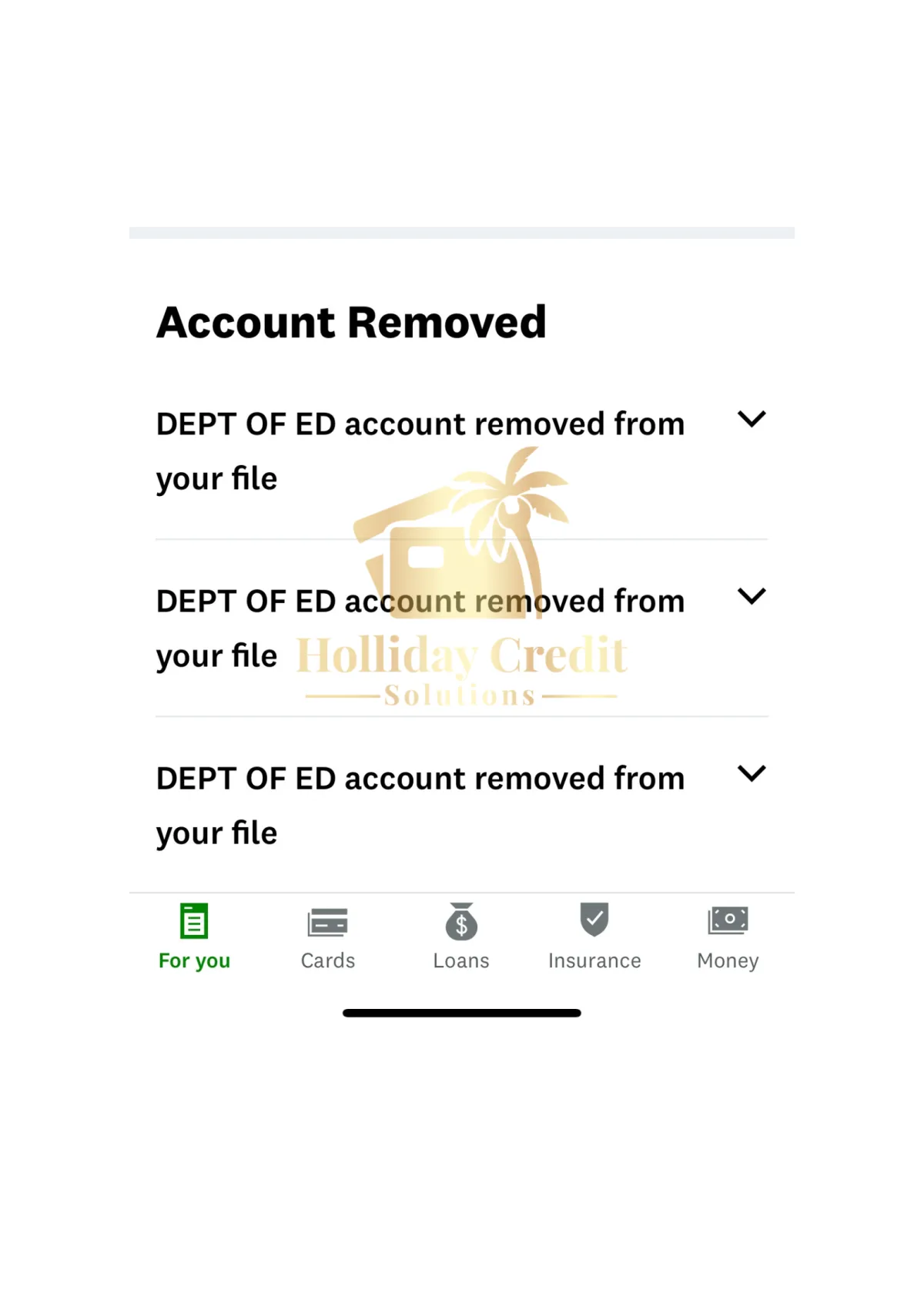

CREDIT Repair

CREDIT SCORE SERVICES

Boost your credit and take charge of your financial future with our Personal Credit Services. We offer personalized support to repair, build, and maintain strong credit through expert guidance, dispute help, and credit education.

CREDIT SCORE SERVICES

CREDIT SCORE SERVICES

Boost your credit and take charge of your financial future with our Personal Credit Services. We offer personalized support to repair, build, and maintain strong credit through expert guidance, dispute help, and credit education.

Boost your credit and take charge of your financial future with our Personal Credit Services. We offer personalized support to repair, build, and maintain strong credit through expert guidance, dispute help, and credit education.

TAX SERVICES

Make tax time easy and stress-free! Our Tax Preparation services maximize your refund, ensure full compliance, and offer personalized support for individuals, families, and small businesses—all year round.

TAX SERVICES

TAX SERVICES

Make tax time easy and stress-free! Our Tax Preparation services maximize your refund, ensure full compliance, and offer personalized support for individuals, families, and small businesses—all year round.

Make tax time easy and stress-free! Our Tax Preparation services maximize your refund, ensure full compliance, and offer personalized support for individuals, families, and small businesses all year round.

Funding

Get the funds your business needs to thrive. We provide fast, tailored business funding solutions—from loans to lines of credit—to power your growth, inventory, and operations with confidence.

Funding

Funding

Get the funds your business needs to thrive. We provide fast, tailored business funding solutions—from loans to lines of credit—to power your growth, inventory, and operations with confidence.

Get the funds your business needs to thrive. We provide fast, tailored business funding solutions from loans to lines of credit to power your growth, inventory, and operations with confidence.

THE EXCLUSIVE CREDIT TRANSFORMATION PROVIDES YOU WITH:

THE EXCLUSIVE CREDIT TRANSFORMATION PROVIDES YOU WITH:

Secrets to increase your credit score.

Secrets to increase your credit score.

How to build positive tradelines.

How to build positive tradelines.

Know THE EXACT steps to eliminate ALL the negative remarks on your credit report within 100 days or less!

Know THE EXACT steps to eliminate ALL the negative remarks on your credit report within 100 days or less!

SO YOU CAN...

SO YOU CAN...

Buy or Refinance Your Home.

Buy or Refinance Your Home.

Purchase a new vehicle.

Purchase a new vehicle.

Boost financial confidence.

Boost financial confidence.

Get Approved for High limit credit cards.

Get Approved for High limit credit cards.

Qualify for lower interest rates.

Qualify for lower interest rates.

Boost Your Credit Score

WITHIN DAYS!

Boost Your Credit Score

WITHIN DAYS!

YOU'RE ONE STEP CLOSER TO CONQUERING POOR CREDIT ONCE AND FOR ALL.

_______________________________________________________________________________

YOU'RE ONE STEP CLOSER TO CONQUERING POOR CREDIT ONCE AND FOR ALL.

_______________________________

THE PROCESS

Make Your Tax Business Problem Free!

Notary Service

Notary Service

Notary Service

Advance Refund

Advance Refund

Advance Refund

Tax Preparation

Tax Preparation

Tax Preparation

Financial Report

Financial Report

Financial Report

Bookkeeping

Bookkeeping

Bookkeeping

Loan Approval

Loan Approval

Loan Approval

How to File

How to File

Schedule Your Call

Schedule Your Call

Book a call with me to get started and discuss your tax and/or business

needs.Call to Action Headline

Book a call with me to get started and discuss your tax and/or business

needs.Call to Action Headline

Create Your Business Account

Create Your Business Account

Book a call with me to get started and discuss your tax and/or business

Fill out the form completely to create your account

Book a call with me to get started and discuss your tax and/or business

Fill out the form completely to create your account

Meet Your Tax Preparer

Meet Your Tax Preparer

We will contact you within 24 hours to assist you.

We will contact you within 24 hours to assist you.

Hassle-Free Services

Hassle-Free Services

We will work with you every step of the way to ensure your tax filing and business needs are completed accurately and efficiently.

We will work with you every step of the way to ensure your tax filing and business needs are completed accurately and efficiently.

Review & Payment

Review & Payment

Once your tax return or business needs are ready, you’ll review and sign your draft before making a payment.

You’re All Done! Now What?

You’re All Done! Now What?

After payment is made in full, we will handle the filing or implementation of your business needs—giving you peace of mind.

After payment is made in full, we will handle the filing or implementation of your business needs—giving you peace of mind.

Testimonials

I used to dread tax season, but working with Mr. Holliday's team made it simple. They not only handled my complex small business return flawlessly, but also found deductions I didn't even know existed. I felt completely confident in my filing and ended up maximizing my refund. Highly recommend their expertise!"

John D

When my business needed quick capital for expansion, I reached out to Mr. Holliday. They didn't just give me a generic loan application; they found me the perfect funding solution with great rates. The entire process was fast, transparent, and stress-free. They truly understand what it takes to grow a business

Sarah M

When my business needed quick capital for expansion, I reached out to Mr. Holliday. They didn't just give me a generic loan application; they found me the perfect funding solution with great rates. The entire process was fast, transparent, and stress-free. They truly understand what it takes to grow a business

When my business needed quick capital for expansion, I reached out to Mr. Holliday. They didn't just give me a generic loan application; they found me the perfect funding solution with great rates. The entire process was fast, transparent, and stress-free. They truly understand what it takes to grow a business

Sarah M

When I needed financing to take my business to the next level, Mr. Holliday and his team went above and beyond. They took the time to understand my goals and matched me with a funding option that fit perfectly. The process was smooth, communication was clear, and everything was handled quickly. I really appreciated their professionalism and genuine interest in helping my business succeed. Highly recommend!

Brent A

When I needed financing to take my business to the next level, Mr. Holliday and his team went above and beyond. They took the time to understand my goals and matched me with a funding option that fit perfectly. The process was smooth, communication was clear, and everything was handled quickly. I really appreciated their professionalism and genuine interest in helping my business succeed. Highly recommend!

Brent A

Frequently Asked Questions

What tax services do you offer for businesses and individuals?

We offer a full range of tax services, including business tax preparation and filing (e.g., corporate, partnership), individual tax returns (e.g., 1040), strategic tax planning to minimize liability, and IRS audit support and resolution. We focus on ensuring compliance and maximizing your legal deductions

How long does the credit bootcamp take, and what results can I expect?

The timeline for credit repair varies based on the complexity and number of negative items on your report, but typically takes 90 to 180 days to see significant results. We work to challenge and remove inaccurate, obsolete, or unverifiable items, focusing on improvements in your credit score and financial profile.

What types of business funding do you help secure?

We connect your business with a variety of funding options, including term loans, lines of credit, equipment financing, and Small Business Administration (SBA) loans. We assess your financial needs and eligibility to match you with the best capital source to support your growth, expansion, or operations.

How do you charge for your services?

Our pricing depends on the specific service. For tax preparation, we offer fixed, transparent pricing based on the complexity of your return. For credit repair, we typically charge a monthly service fee. For business funding, our fee is a small percentage of the capital successfully secured for your business. We provide a full quote before starting any work.

Is credit bootcamp program necessary before seeking business funding?

While not always mandatory, improving your personal and business credit is highly recommended as it often leads to lower interest rates and better approval odds for business loans. We often recommend a simultaneous approach, working on your credit while preparing your business financials for funding applications.

Do I need an appointment, and how do I get started?

Yes, we recommend scheduling a free, no-obligation consultation to review your specific tax, credit, or funding needs. You can easily book an appointment bclicking the button below/visiting our 'Contact Us' page/calling our office]. We'll discuss your goals and outline a clear plan for moving forward.

Get in Touch with Us

Social Media:

LeRoy Holliday iii

Holliday Credit Solutions

Social Media:

LeRoy Holliday iii

Holliday Credit Solutions

Social Media:

LeRoy Holliday iii

Holliday Credit Solutions

Phone:

(725) 255-2276

Phone:

(725) 255-2276

Email: